One of the most appealing features of saving with a 529 plan are the federal tax benefits. Some plans, including College Savings Iowa, offer additional benefits for its state residents. We understand knowing exactly what those benefits mean can be difficult. That’s why we’re here to break it down for you – follow along!

Federal Benefits

Tax-Deferred Earnings

College Savings Iowa, and many other 529 plans, offer a variety of options to invest your money, which gives your money the opportunity to grow beyond the initial contribution amount. That growth, called earnings, may grow free from federal income tax.

Tax-Free Qualified Withdrawals

Similarly, the federal government will not tax the money you use to pay for qualified education expenses. This includes tuition, room and board, computers, textbooks and more at any eligible education institution in the U.S. or abroad. Additionally, up to $10,000 per year can be withdrawn to pay for tuition at a qualified K-12 public, private or religious school. Learn more on our Qualified Expenses page.

Iowa Taxpayer Benefits

Tax-Deferred Earnings

Similar to the federal benefit, the growth on your investments may grow free from Iowa income tax.

Tax-Free Withdrawals

Here is a key difference between federal and Iowa tax benefits for withdrawals – if you are an Iowa taxpayer, all withdrawals are free from state income taxes. This is one of the many reasons you should consider your home state when comparing 529 plans; it’s important to know the benefits each state offers to its residents.

State Income Tax Deduction

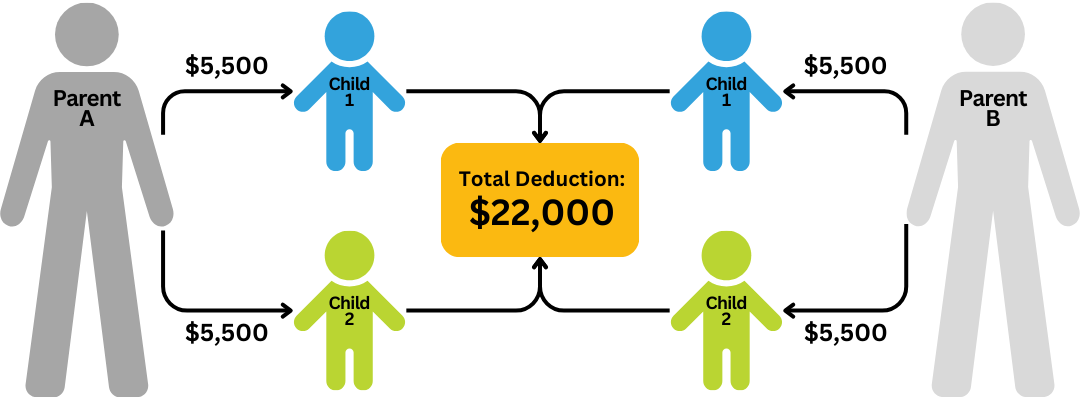

Last, but certainly not least – the state income tax deduction for Iowa taxpayers. If a Participant (saver) is an Iowa taxpayer, they can deduct up to $5,500 in contributions per Beneficiary account from their state income taxes in 2024. Keep in mind this number is adjusted annually for inflation.

Why are deductions important? According to the IRS, they can reduce the amount of your income before you calculate the tax you owe, which generally reduces the amount of tax the individual may have to pay.

But wait, there’s more! Families can maximize their state tax deduction. For example, if a married couple is filing jointly and they each have a College Savings Iowa account for their two children, and contribute at least $5,500 per Beneficiary account, they can each take the state income tax deduction. In 2024, that’s a $22,000 deduction!

The Conclusion

Tax benefits are just one of the many advantages of saving with a 529 plan, but ultimately, we know your goal is to help a student in your life achieve their education dreams. We hope this article was helpful in understanding the tax-benefits of getting you there.

Still have questions? Visit our Tax Benefits page to learn more or contact our education savings specialists to ask an expert.

Read the Program Description for details about College Savings Iowa.